Do you want to beat the crypto market but don’t have time to sit and watch charts every day? Then crypto swing trading might be a perfect option for you. Swing trading has emerged as a popular and accessible strategy for those looking to profit from the dynamic world of cryptocurrency.Swing trading is a flexible strategy that aims to blend long-term investing with high-intensity day trading and provides a means to profit from the price volatility of digital assets. In this article, we’ll explore the art of crypto swing trading and present you with some of the easiest-to-follow strategies.

What is swing trading crypto?

A technique that aims for medium-term returns in the cryptocurrency market is swing trading. Swing trading concentrates on capturing price variations that normally occur over a time frame of a few days to several weeks, as opposed to the quick speed of day trading or the long-term commitment of traditional investment.

Crypto swing traders are skilled at navigating the turbulent landscape of digital assets by combining a number of trend-following strategies. This approach combines technical and fundamental analysis, placing special emphasis on the value of knowing market trends, asset fundamentals, and how different market forces interact.

The large selection of tools and methods available to traders is one of the distinctive aspects of swing trading. A crypto swing trader’s toolbox frequently consists of a wide range of indicators and strategies, each of which is specifically designed to address a different market environment and set of trading goals. Swing traders investigate a wide range of choices to make educated trading selections in search of those sought-after medium-term returns, whether it be through the use of moving averages, relative strength indicators, or complicated chart patterns.

What indicators to use for crypto swing trading?

Crypto swing trading, a strategy designed to capture medium-term gains, places a strong emphasis on the use of trend-following indicators. Given that the typical duration of a swing trade rarely extends beyond two weeks, the choice of time frames becomes a critical factor in this trading style. Swing traders often rely on chart intervals ranging from 1 hour to 1 day to make informed decisions.

While there’s nothing particularly extraordinary about the indicators used in swing trading, they share much in common with those employed in other trading styles. Familiar tools such as moving averages, MACD (Moving Average Convergence Divergence), and Bollinger Bands are standard fixtures in a swing trader’s toolkit.

Nonetheless, some indicators tend to be more prevalent among swing traders than their counterparts in day trading or scalping. For swing traders, it’s crucial to identify local highs and lows while also identifying trends that can potentially persist for several days. Consequently, swing traders prioritize the use of trend indicators over oscillators when entering positions.

Swing traders frequently use indicators like moving averages and MACD, which offer helpful perceptions into market movements, to start a trade. Additionally, they usually make use of tools like trend lines and Fibonacci retracement levels to support their trading judgments.

When it comes to exiting a position, swing traders favor reversal indicators and oscillators. In this context, the Relative Strength Index (RSI), stochastic oscillator, and similar tools come into play, aiding traders in identifying opportune moments to exit their positions, thus securing their hard-earned gains. The combination of these indicators empowers swing traders to navigate the crypto market with precision, striking a balance between timing and profitability in the ever-evolving landscape of digital assets.

Brokers to use for crypto swing trading

For swing trading you should choose from brokers with a low overnight position cost. This is the case if you are using leverage on your positions. Brokers listed below offer margin and/or futures accounts for the maximum profits on your positions with low upkeep cost.

Crypto swing trading strategies

Crypto swing traders employ a diverse array of strategies, often combining multiple approaches to optimize their trading performance. Among the myriad strategies at their disposal, there are some fundamental concepts that serve as cornerstones for finding entry and exit points in the world of crypto swing trading.

Breakouts

Breakouts are a fundamental strategy in crypto swing trading, involving the moment when the price of a cryptocurrency surpasses a resistance level or drops below a support level. Such a move signals the potential initiation of a new trend in the direction of the breakout. Breakouts are often accompanied by a surge in trading volume around these critical support or resistance levels.

Beyond serving as entry points, breakouts also play a pivotal role in setting stop-loss levels. In long positions, traders place their stop-loss orders just below the breakout area, while in short positions, they position them just above the breakout area.

Numerous chart patterns, such as triangles, flags, head-and-shoulders formations, and more, are amenable to breakout techniques. This strategy’s subjectivity in determining support and resistance levels presents a hurdle because various traders may interpret patterns differently. Since true breakouts frequently coincide with a discernible rise in trading volume, volume data becomes an invaluable tool for identifying genuine breakout levels.

Chart patterns and trendlines

Chart patterns and trendlines are indispensable tools for identifying key levels in crypto swing trading. Trendlines are created by connecting local lows in an uptrend and local highs in a downtrend. They not only help pinpoint support and resistance levels but also serve as references for setting stop-loss and take-profit levels.

Chart patterns are created when multiple trendlines come together. These patterns serve as a trader’s roadmap for probable price fluctuations in the future. The most popular chart patterns include head-and-shoulders formations, triangles, and flags. Swing traders can predict the market’s future direction by expertly reading these patterns.

Moving averages

Moving averages are a useful indicator of market patterns, especially when short-term and long-term moving averages interact. An uptrend is indicated when the short-term moving average crosses above the long-term moving average, while a downtrend is indicated by the opposite.

Combining moving averages with additional indicators and chart patterns is a common strategy. For instance, traders may use the “buying the dip” approach, which entails looking for advantageous times to open long positions during transient market dips, if moving averages point to an advance.

These tactics give traders the resources they need to make informed decisions about whether to enter or quit positions in the volatile realm of swing trading in cryptocurrency. Swing traders in the cryptocurrency market can maneuver the market’s oscillations with agility and precision by utilizing the power of breakouts, chart patterns, trendlines, and moving averages.

Elliott Wave Theory in crypto swing trading

Elliott Wave Theory, developed by Ralph Nelson Elliott, stands as a cornerstone of technical analysis, shedding light on the intricate dance of price movements within financial markets. This theory holds a special place in the hearts of traders, especially those who thrive on capturing trends and riding the waves of market fluctuations. At its core, Elliott Wave Theory unveils the behavior of markets during trending phases, providing invaluable insights for crypto swing trading.

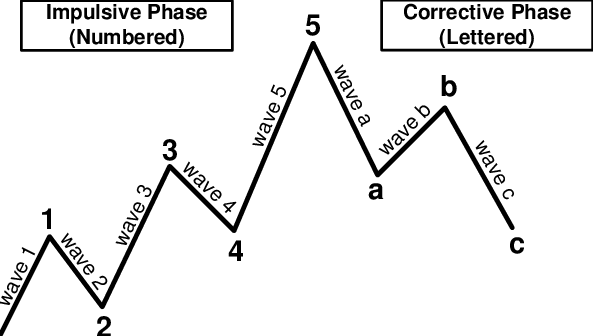

Understanding Wave Patterns

The idea of waves serves as the foundation of Elliott Wave Theory. Whether it be commodities or cryptocurrency, these waves show different patterns in the price movements of assets. Trading participants attempt to predict and profit from upcoming price developments as they maneuver these waves. The theory introduces various wave types, each with their own special properties.

Motive Waves: These waves signify the heart of a trend and are further divided into Impulse Waves and Corrective Waves. Motive waves move in the same direction as the broader trend, driving price higher in uptrends or lower in downtrends.

Impulse Waves: Impulse waves, a subset of motive waves, consist of five sub-waves that collectively generate net movement aligned with the trend of the next-largest degree. This pattern of continuous progress is a hallmark of sustained market momentum.

Corrective Waves: Corrective waves, sometimes referred to as diagonal waves, manifest as a trio of sub-waves (or a combination thereof) that work in unison to produce net movement opposite to the trend of the next-largest degree. These waves provide the necessary respite for markets to pause, consolidate, or adjust course.

Interpreting Wave Theory in Crypto Swing Trading

Instead of providing explicit trading recommendations, Elliott Wave Theory equips traders with the knowledge they need to explore the trends in cryptocurrency prices. Traders that are familiar with the subtleties of this approach read cryptocurrency charts using wave patterns. Traders can predict the developing market dynamics and make better trading decisions by identifying these waves in the price action.

It’s important to recognize that Elliott Wave Theory is only a guide for those willing to set out on a quest to comprehend the complexities of the crypto markets and does not promise complete certainty. Crypto swing traders that adopt the theory acquire a competitive edge in interpreting and navigating the waves of opportunity that the theory provides by providing a window into the mechanics of trending markets.

Crypto swing trading vs day trading?

There are several ways to approach cryptocurrency trading, but swing trading and day trading stand out as the two most popular strategies. The choice between each approach depends on personal preferences, trading goals, and risk tolerance. Each method offers a unique set of characteristics. Here, we examine the main distinctions between these two trading approaches.

Time Horizon

Swing Trading: Swing trading, by definition, centers on capturing profits from longer-duration trades. Swing traders typically hold positions for several weeks to months, aiming to capitalize on medium-term market trends.

Day Trading: In stark contrast, day trading is characterized by a swift and relentless pace. Day traders open and close multiple positions within a single trading session, often with an emphasis on short-term price movements.

Indicators

Swing Trading: Swing traders favor indicators suited for identifying and following trends over extended periods. These include moving averages, Fibonacci retracement levels, and trend lines.

Day Trading: Day traders, focused on seizing intraday opportunities, rely on oscillators to pinpoint precise reversal points. Common indicators include the Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), Bollinger Bands, and Stochastic indicators.

Timeframes

Swing Trading: Swing traders generally employ longer timeframes, ranging from 1 hour to 1 day charts, which align with their medium-term trading horizon.

Day Trading: Day traders gravitate toward shorter timeframes, from as brief as 5 minutes to 1 hour, as they aim to capitalize on the rapid fluctuations within a single trading day.

Strategies

Swing Trading: Swing traders predominantly adopt trend-following strategies, striving to ride the waves of sustained price movements over time.

Day Trading: Day traders specialize in market reversal strategies, attempting to pinpoint turning points in the market during the course of a single trading session.

Risk Management

Swing Trading: Given the extended holding periods, swing traders typically employ smaller leverages and position sizes. This approach helps mitigate the risk of overnight events, such as negative news or unforeseen market developments.

Day Trading: Day traders often allocate a larger portion of their portfolio to positions, along with the use of higher leverages. This strategy offers the advantage of acting swiftly on market movements but also exposes traders to rapid and potentially larger losses.

Is Swing Trading Crypto More Profitable than Day Trading?

The answer to this question is nuanced and depends on various factors. Both trading styles come with their own sets of advantages and drawbacks. Swing trading is less time-consuming and may be a more practical choice for individuals with full-time jobs. In terms of profitability, a trader’s success hinges on their skills, not solely their chosen style. Both swing and day trading have their inherent risks, and the right choice ultimately depends on a trader’s personality, lifestyle, and aptitude for managing those risks effectively.

In the dynamic world of cryptocurrency trading, finding the right balance between these two styles can be the key to a successful trading journey. Whether one chooses to ride the waves of swing trading or navigate the fast-paced currents of day trading, adaptability and a deep understanding of the chosen strategy are paramount.

Conclusion

The selection between swing trading and day trading is crucial for traders in the wide and constantly changing world of bitcoin trading. Every style has a distinctive set of traits and trade-offs, so it’s crucial to match your selected strategy with your specific goals, way of life, and level of risk tolerance.

Patience and the capacity to identify medium-term trends are essential components of swing trading. It is suitable for those who can’t trade all day and are at ease with overnight risk. Swing traders skillfully ride the waves of the cryptocurrency market by using indicators that follow trends and looking at larger periods.

On the other hand, day trading is a relentless endeavor that depends on seizing intraday opportunities. It necessitates the ability to move quickly, frequently using greater leverage and shorter timelines. Quick responses to market movements and the possibility of greater relative earnings within a single trading session are two advantages.

There is no definite answer to the question of whether swing trading is more profitable than day trading. Profitability is based on a trader’s abilities, not only their preferred trading method. The best option depends on personal preference and a thorough understanding of how to minimize the dangers involved in each method. Both carry different sets of risks.

Traders can succeed with either approach in this dynamic crypto trading environment. The trick is to select the one that best suits your personality, objectives, and risk-management skills. Whether you’re riding the waves of swing trading or navigating the swift currents of day trading, finding the perfect balance can help you find your way to success in the fascinating world of cryptocurrency trading.